About the Mandanas-Garcia Ruling

Lifted from the Frequently Asked Questions published by the Department of Budget and Management)

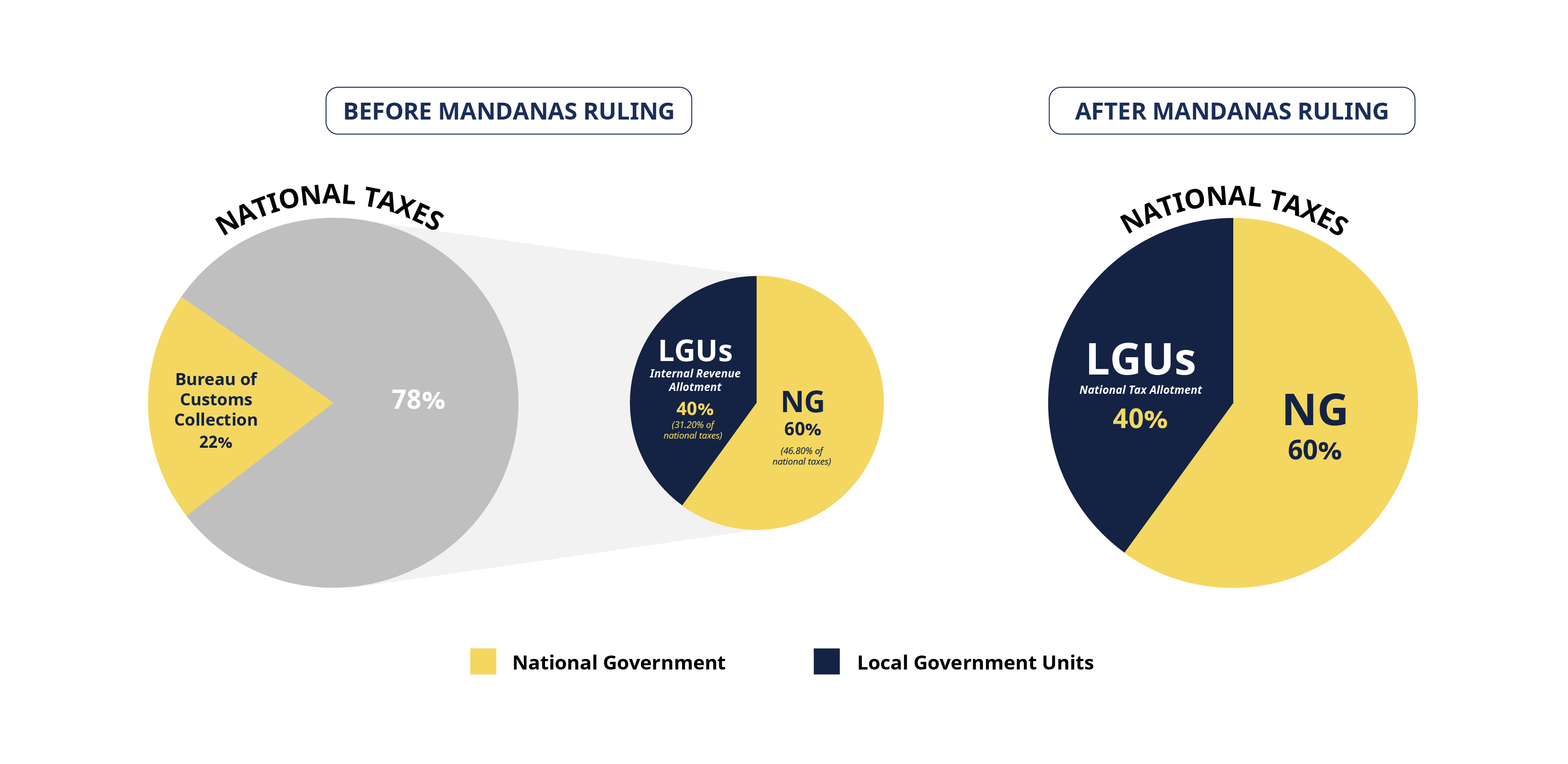

In 2018, the Supreme Court (SC) ruled the petitions filed by Congressman Hermilando I. Mandanas, and Congressman Enrique T. Garcia, et al., about the National Government’s manner of computer the Internal Revenue Allotment (IRA) shares of the local government units (LGUs). The SC decided that the just share of LGUs from the national taxes is not only based on the national internal revenue taxes collected by the Bureau of Internal Revenue (BIR), but also on all national taxes, which became final and executory last April 10, 2019. To carry out the decision of the SC, President Rodrigo Duterte released on June 1, 2021 Executive order (EO) No. 138 mandating the full devolution of basic services from the national government agencies (NGAs) to local government units (LGUs).

The Impact of the Mandanas-Garcia Ruling

The impact of the SC decision significantly increased the tax base on which the share of the LGUs is computed from, and thus, strengthened fiscal decentralization. It clarifies the distinction between “national internal revenue taxes” and “national taxes” as base in the computation of the IRA of LGUs.

National internal revenue taxes include only taxes collected by the Bureau of Internal Revenue (BIR) while “National taxes,” consists of all taxes and duties collected by the NG through the BIR, the Bureau of Customs (BOC), and other collecting agencies.

The Implications of the Mandanas-Garcia Ruling on the National Governments and the Local Government Units

Based on the certifications issued by the BIR, BOC, and Bureau of the Treasury (BTr), the fiscal implication of the SC ruling implementation is about PhP959.04 Billion, which is equivalent to a 37.89 percent increase or around PhP263 billion from the FY 2021 IRA shares of LGUs.

The implications of this bigger allocation for LGUs are as follows:

- This presents a unique opportunity for the LGUs to assume the functions that have been devolved to them under the 1991 LGC and other subsequent and pertinent laws.

- On the other hand, this will significantly diminish the fiscal resources available to the NG for its key priorities and commitments in reducing poverty, promoting infrastructure and human capital development, and pursuing peace and order in the country, starting 2022.

For fiscal sustainability, however, the devolved functions under the LGC should be fully and permanently, albeit gradually, be turned over by the NGAs to the LGUs. The NGAs should then pursue a long-term institutional development program for the LGUs to strengthen their capacities and capabilities to assume the devolved functions.

Salient Features of Executive Order (EO) No. 138 and its Implementing Rules and Regulations (IRR)

Delineation of National and Local Government Roles

- The functions, services and facilities are based on Section 17 of the Local Government Code (LGC) of 1991 and other pertinent laws.

- Functions, services and facilities are to be fully devolved from the National Government to Local Government Units (LGUs) not later than the end of Fiscal Year 2024.

- This covers all LGUs, and departments, agencies, and instrumentalities of the Executive Branch whose functions are in line with those devolved under the 1991 LGC.

Creation of Committee on Devolution (ComDev)

- The ComDev is tasked to oversee and monitor the implementation of the EO.

- It is composed of

- the Secretary of the Department of Budget and Management (DBM), as Chairperson;

- the Secretary of the Department of Interior and Local Government (DILG), as Co-Chairperson; and

- the Secretaries from the National Economic Development Authority (NEDA), and the Department of Finance (DOF); Executive Secretary and Presidents of the Leagues of Provinces / Cities / Municipalities of the Philippines, Liga ng mga Barangay sa Pilipinas, and Union of Local Authorities of the Philippines, as Members.

- Regional ComDevs are created to serve as counterparts of the ComDev at the regional level. These are to be constituted as a special committee under the Regional Development Councils. The Regional ComDev shall be composed of

- the Regional Director of the Department of Budget and Management (DBM), as Chairperson;

- the Regional Director of the Department of Interior and Local Government (DILG), as Co-Chairperson; and

- the Regional Director of the National Economic Development Authority (NEDA), and the Department of Finance (DOF) – Bureau of Local Government Finance (BLGF); and representatives from the regional offices of NGAs concerned and LGU Leagues, as Members.

Preparation of Devolution Transition Plans (DTPs)

National Government Agencies (NGAs)

- NGA DTPs should include the following:

- Identification and clarification of functions and services devolved and strategy for and phasing of devolution.

- Standards for delivery of devolved services.

- Strategy for capacity development of LGUs.

- Monitoring and performance assessment framework for LGUs.

- Organizational effectiveness proposal

- A Department / Agency Devolution Transition Committee should be organized to coordinate and oversee the entire preparation process.

Local Government Units (LGUs)

All provinces, cities, municipalities, and barangays have to prepare their DTPs in close coordination with NGAs concerned.

DTPs shall guide LGUs towards full assumption of devolved functions and services, and serve as guide by NGAs concerned, DBM and DILG on monitoring and performance assessment of LGUs.

Local chief executives have to spearhead preparation of LGU DTPs and organize the LGU DTC; Local Sanggunian to review and approve LGU DTP through a Sanggunian Resolution.

DBM and DILG will jointly issue the guidelines on the preparation of the NGA and LGU DTPs

DBM is tasked to review and approve NGA DTPs; DILG to guide and monitor the submission of LGU DTPs.

Establishment of Growth Equity Fund

A Growth Equity Fund shall be established starting FY 2022 to address problems of marginalization, unequal development, high poverty incidence, and disparities in net fiscal capacities of LGUs.

Capacity Building for National Government Agencies (NGAs) and Local Government Units (LGUs)

- Capacity Development Agenda for LGUs has to be formulated based on DILG – Local Government Academy’s (LGA) assessment framework, and guided by capacity development strategy contained in NGA DTPs, local development thrusts, and performance goals and objectives.

- The DILG, through LGA, has to oversee and harmonize provision of capacity development interventions for LGUs.

- Capacity development interventions are to be offered preferably to career or permanent local government personnel as a means of institutional strengthening.

Strengthening of Planning, Investment Programming, and Budgeting Linkage and Monitoring and Evaluation Systems

- Vertical and horizontal linkages across different levels of government in development planning, investment programming and budgeting should be strengthened, and areas of convergence should be identified.

- Results-based monitoring and evaluation systems shall likewise be in place and strengthened to ensure purposive conduct of evaluations in the performance and delivery of devolved functions and services.

Options for Affected NGA Personnel

- Transfer to other units within the agency.

- Transfer to other agencies within the Executive Branch.

- Retire or separate from the service, and apply to vacant positions in LGUs.

Roles of Non-Government Organizations (NGOs), Civil Society Organizations (CSOs), and People’s Organizations (POs)

- NGAs and LGUs shall recognize the role of NGOs / CSOs / POs in enhancing transparency, accountability, and good governance, and as active partners in pursuit of local autonomy.

- NGOs/CSOs/POs are encouraged to participate in the preparation, implementation and monitoring of the DTPs of NGAs and LGUs through consultations and public dialogues.

In cooperation with:

Have any questions? Feel Free to Contact Us.

- 63-289264136

- mandanasruling@gmail.com

© COPYRIGHT 2021 . MANDANAS RULING PH. ALL RIGHTS RESERVED.